Mycroft: A Sherlockian Chronicle of Financial Forensics

Dr. Watson’s Journal: Financial Forensic Basics

You’ve been tasked with finding an expert on a fraud case, or to value an asset at issue in litigation, or to calculate economic damages. Where do you turn?

First be aware of the alphabet soup of designations for experts in financial forensics.

Valuation Credentials

You might look to a Certified Public Accountant, or CPA. Perhaps a CPA with specialized CPA-upgrade credentials like CFF (Certified in Financial Forensics) or ABV (Asset and Business Valuation). The CFF and ABV credentials were developed by the AICPA to help CPAs who are practicing forensic accountants serve as expert witnesses in valuation and other forensic engagements and survive Daubert review. A wealth of courts have relied on those designations and the professional standards associated with the designations to meet Daubert scrutiny.

Other standalone valuation credentials include the Certified Financial Analyst (CFA) credential and the Certified Valuation Analyst (CVA) credential. The first is more rigorous than the second, but both have been accepted by courts certifying experts in valuation cases.

Economic Damages Estimation Credentials

This work tends to be the province of either PhD economists who a times describe their speciality as forensic economists, or the CPA/CFF combo credential described above. More on the National Association of Forensic Economics here. Here’s one effort to distinguish between the forensic economist and forensic accountant roles.

Financial Fraud Investigation Credentials

This category is squarely within the province of the CPA/CFF. Another credentialing organization is the Association of Certified Forensic Examiners who offer the CFE credential. CFE is less rigorous than the CPA/CFF but can be a good companion to CPA/CFF holders as CFE training encompasses more non-financial fraud investigations not covered by CPA/CFF licensing.

Mycroft’s Armchair Forensics Advice

Damages estimation during the days of Covid are tricky. Interest rates are near zero, typical benchmarks in industry peers are distorted by Covid. AICPA has a task force on damages estimation during Covid. Interesting article here.

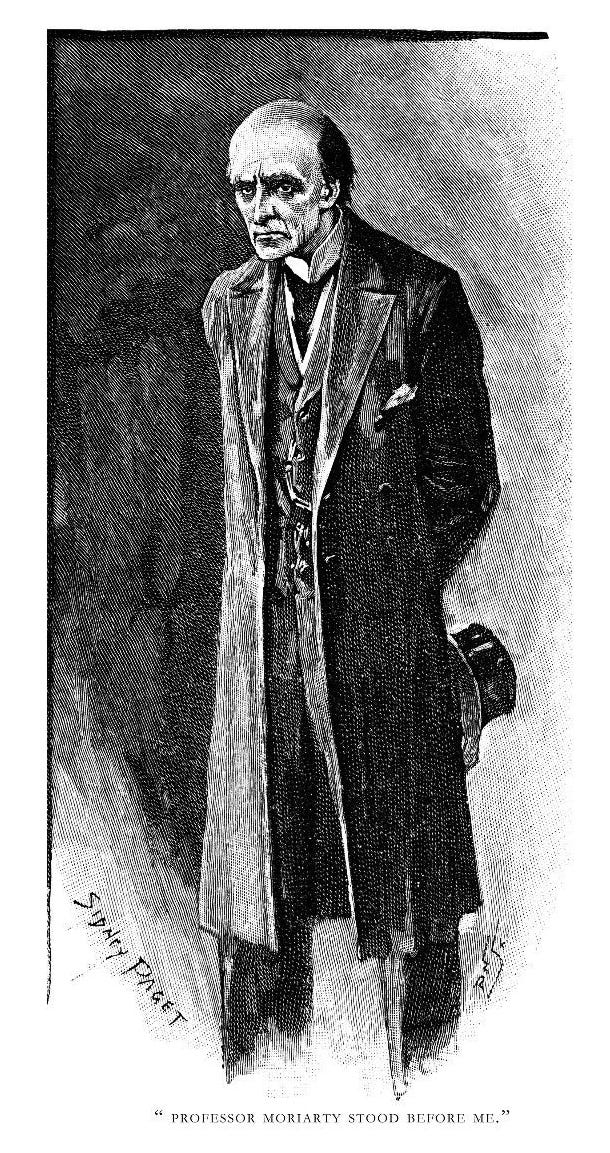

Professor Moriarty’s Laboratory: Tales of Fraud

WeWork might or might not have been quite fraud, but it was an accounting disaster. Francine McKenna at The Dig has more. (The Dig is another interesting newsletter I’d recommend to you on accounting and fraud, subscribe here)

Theranos. So much to say about Theranos. At it’s core not a financial fraud, but so many financial implications. More here.